Are Financial Services Ready For The Metaverse?

/4.png?width=200&name=4.png)

As Financial Service organisations, insurers and banks look for new ways to interact and engage with their customers and partners to boost acquisition and improve the bottom line, many are considering how they could utilise metaverse technologies.

Major players such as HSBC and JPMorgan are already leading the way in adopting the technology, with the latter’s report, Opportunities in the Metaverse, estimating that the metaverse poses a market opportunity of $1trn in annual revenue.

Creating world-class digital experiences

As organisations look to the future, having a metaverse presence has the potential to not only create virtual environments for staff and customers, but provide new ways to analyse trends, as well as extend digital operations into areas like cryptocurrencies, and generally provide a more immersive customer experience.

Although it has existed in some shape or form for more than two decades, the metaverse is finally becoming mainstream. Gartner predicts that in the next four years, one in four people will spend at least an hour a day in the metaverse, performing a range of tasks and activities from shopping and socialising to attending work events and distance learning. With leading tech companies like Meta (previously Facebook, Inc.), Google and Microsoft investing billions of dollars into the technology, there is no denying that it has the potential to revolutionise the way that companies engage and communicate with customers much like social media has over the past two decades.

As our lives moved online during the pandemic, the way we consume digital services like mobile banking or online shopping changed. As consumers, we don’t just compare digital experiences between competitors – but to the last great digital experience that we had; be that on our favourite fashion brand’s app or speaking with a virtual representative from our bank. Customers are demanding new ways to engage and bridging the gap between physical and virtual worlds could, therefore, help firms attract new, digitally native customers, as well as embrace and integrate new products like ‘metaverse mortgages’ and NFTs.

However, FSI providers face challenges when it comes to balancing these digital ambitions with the reality of their complex hybrid IT environments and modernising their decades-old legacy environments.

Balancing agility and governance

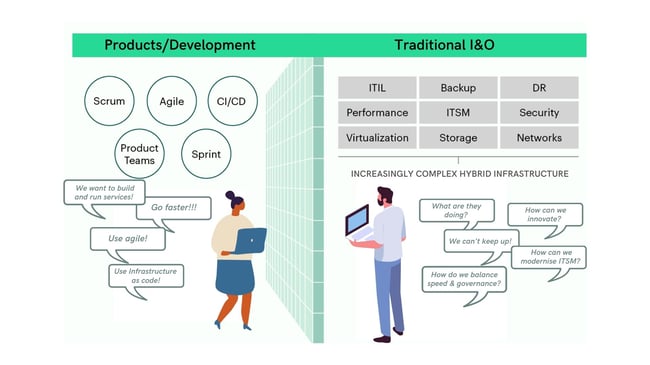

Despite a real willingness from banks to accelerate the pace of digital change, this often adds to the proliferation of homegrown and third-party technologies, platforms, systems, and environments. To keep up with the pace of change, banks created DevOps-led product teams with the mandate to ‘go fast and break things'. Often, these teams are siloed from the I&O (Infrastructure & Operations) teams who are responsible for ensuring that the infrastructure these new products and services are delivered on is secure, compliant, and safe, but this approach is often not agile enough to meet developer’s needs.

This wall between DevOps and I&O is a barrier to the agility and resilience needed to achieve digital ambitions.

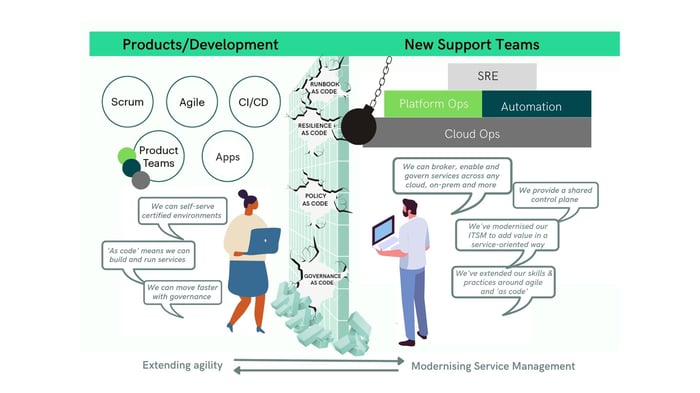

IT now, more than ever, must be service-oriented rather than infrastructure-oriented. I&O teams should modernise their approach to IT service management (ITSM) and become the brokers who enable and govern services across these complex hybrid IT environments.

This means bringing together Platform Ops, Cloud Ops, and SRE (Site Reliability Engineers) to form a modern I&O function which supports and collaborates with its Product cousins and provides them with well-governed self-service environments in which they can innovate.

Automation for really complex IT environments

Essentially, to embrace new digital experiences, banks and FS organisations must adopt service-oriented orchestration and think about how they can move towards environment-as-code.

Environment-as-code elevates infrastructure-as-code to connect Product teams with I&O teams, prioritising both developer agility and governance and allowing them to deliver, manage and orchestrate environments, platforms, and services rapidly, reliably, resiliently and at scale. It can be achieved with automation tools that can deliver full lifecycle orchestration for any application, in any environment and at scale and which provide the centralised control plane required for good governance and compliance.

World-class digital experiences are built on these resilient and secure environments, and this approach can also free up developer time to focus on delivering innovative new services and products – such as those in the metaverse. It will be interesting to see how banks, FS firms and insurers move forward with plans to adopt metaverse technology and not get left behind by their competitors.

Download the one-pager to learn about Environment as Code with Cloudsoft AMP. Like waht you see? Get in touch to arrange a demo.

This article was originally published as the cover story of the June 2022 issue of Finance Monthly.